South Korea’s semiconductor industry is rapidly evolving, fueled by a significant focus on memory technologies and AI-driven innovations. Companies like Samsung and SK Hynix lead the market, with advances in DRAM and NAND flash sectors. Additionally, the government is investing heavily in the sector, allocating KRW 33 trillion by 2025. However, challenges like talent shortages and geopolitical tensions impact growth. We’ll discuss these trends and strategic responses shaping the industry’s future.

Key Takeaways

- Increasing investment in AI-driven chip architectures to enhance performance in edge computing is reshaping design trends in South Korea’s semiconductor market.

- Advanced packaging innovations, such as 3D architectures and panel-level methods, are becoming key focuses to improve semiconductor efficiency and capability.

- The industry is moving towards sustainable materials solutions to address environmental concerns and comply with global sustainability standards.

- A collaborative ecosystem is developing among universities, research institutions, and industry partners to drive innovation and improve technological advancements.

- Despite growth, challenges like talent shortages, geopolitical tensions, and high energy costs must be addressed to sustain the industry’s competitive edge.

Overview of South Korea’s Semiconductor Market Growth

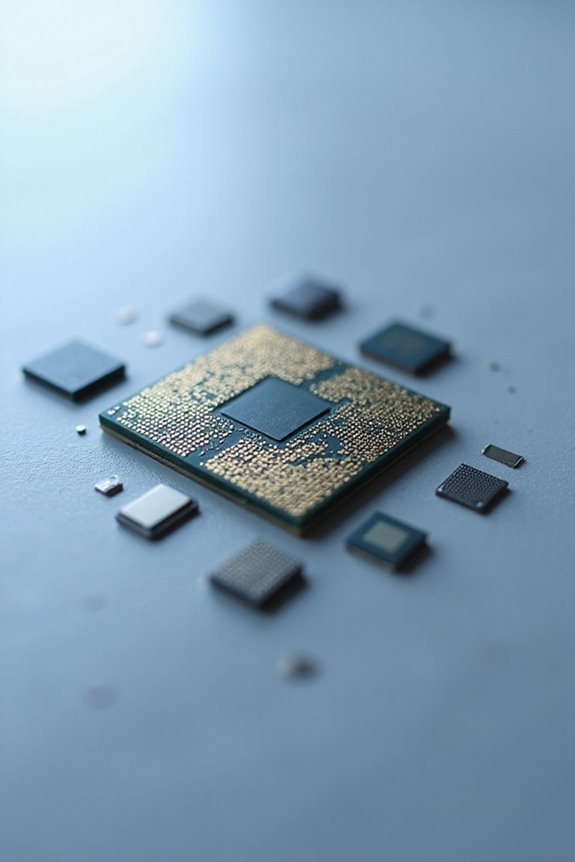

As we examine the growth of South Korea’s semiconductor market, it’s evident that this sector has become a crucial driver of the nation’s economy. Currently valued at approximately USD 115.69 billion, the market is projected to expand markedly, reaching around USD 247.46 billion by 2034. This growth is primarily fueled by robust market dynamics, such as rising demand for consumer electronics and international exports. In fact, semiconductor exports were valued at $129 billion in 2022, underscoring their importance to the economy. Additionally, South Korea plans substantial investments in infrastructure, intending to enhance production capabilities and technological advancements. By prioritizing these growth drivers, the semiconductor industry will likely continue its upward trajectory, reinforcing its essential role in the nation’s economic landscape.

Key Players and Industry Dominance

The competitive landscape of South Korea’s semiconductor industry is primarily shaped by major players like Samsung Electronics and SK Hynix, which together dominate the global memory chip market. With a combined market share exceeding 21%, they exemplify Korean leadership in memory technology, particularly in DRAM and NAND flash sectors. Other companies such as DB HiTek and MagnaChip bolster Korea’s presence with innovations in foundry services and power semiconductors. As we analyze market dynamics, we see Korea rising above Taiwan, Japan, and China, especially in memory chip exports, essential for the economy. The industry’s growth is propelled by a remarkable 79.3% surge in global memory revenue, affirming Korea’s strategic investments in maintaining competitive advantage in the semiconductor space.

Technological Innovations and Trends

With semiconductor technology rapidly evolving, we’re witnessing a significant shift towards innovations driven by artificial intelligence. AI integration is reshaping chip architectures for edge computing, allowing faster and more efficient processing. Furthermore, advanced packaging innovations, like the shift to panel-level methods and 3D architectures, enhance performance and reduce costs. We’re also seeing materials innovation focused on sustainable solutions, which addresses both manufacturing complexity and environmental concerns. Collaborative ecosystems are emerging, bridging universities, research institutes, and industry to co-develop technologies that meet future demands. Additionally, manufacturing advances, including new metrology techniques, enhance precision and quality. Together, these trends illustrate a dynamic landscape in the semiconductor industry that aligns with the needs of modern applications and sustainability goals.

Government Initiatives and Investment Strategies

Innovations in chip technology have prompted a robust response from governments looking to secure their semiconductor industries’ futures. South Korea has committed to investing KRW 33 trillion in the semiconductor sector by April 2025, enhancing innovation and production efficiency. Beyond this, low-interest loans totaling KRW 20 trillion will be available for semiconductor companies from 2025 to 2027, coupled with tax breaks as investment incentives for private R&D and facility investments. Additionally, a KRW 50 trillion fund aims to support advanced industries, including semiconductors, by 2025. This strategic focus on government funding, including a KRW 1.4 trillion policy fund for 2025, underscores the nation’s dedication to fostering a competitive semiconductor ecosystem through substantial financial backing and infrastructural improvements.

Challenges Facing the Semiconductor Industry

As we examine the challenges facing the semiconductor industry, it’s evident that a variety of factors are converging to create a complex landscape. Geopolitical tensions, particularly U.S. export controls, restrict access to critical technologies for South Korean chipmakers. Additionally, projected talent shortages indicate that approximately 54,000 semiconductor workers may be needed by 2031. High energy costs further complicate operations, especially in an industry reliant on power-intensive manufacturing processes. Market competition is fierce, with foreign governments backing rivals through subsidies, as well as evolving demands for innovative products. Finally, workforce challenges, including retaining experienced engineers, threaten our industry’s stability and growth. As we navigate these obstacles, effective solutions will be essential for sustaining our market position.

Emerging Sectors and Applications in Semiconductors

Emerging sectors within the semiconductor industry are poised for significant growth, particularly in areas such as artificial intelligence (AI) and automotive electronics. AI applications are driving demand for specialized processors, including XPUs, which are essential for data centers. Memory semiconductors, specifically DRAM and NAND flash, play a crucial role in supporting AI’s expansion, with a projected market size of $1 trillion by 2030. In automotive electronics, semiconductor demand is expected to rise between 8% and 9% CAGR, mainly due to electric vehicles and advanced driver-assistance systems (ADAS). South Korean companies are investing heavily in emerging technologies, focusing on power and system semiconductors, ensuring they remain competitive in these critical markets.

Future Outlook for South Korea’s Semiconductor Landscape

While we navigate the future of South Korea’s semiconductor landscape, it’s clear that sustained growth will rely heavily on strategic investments and technological advancements. With the market projected to nearly double to $247.46 billion by 2034, we must enhance our supply chain resilience through effective government initiatives and private sector partnerships. Major investments totaling approximately $470 billion for a semiconductor mega cluster will boost competitive positioning. Additionally, focusing on AI chip technology and overcoming current inefficiencies, like the challenges faced by Samsung, is vital. As we adapt to market competition and geopolitical pressures, the government’s commitment to innovation and infrastructure will help mitigate risks, ensuring South Korea remains a key player in the global semiconductor landscape.

Frequently Asked Questions

How Does South Korea’s Semiconductor Industry Influence Job Growth Locally?

We see South Korea’s semiconductor industry greatly driving job creation and bolstering the local economy. As demand grows, it’s essential we focus on training programs to guarantee a skilled workforce meets these emerging opportunities.

What Environmental Considerations Are Being Integrated Into Semiconductor Manufacturing?

In the dance of innovation, we’re embracing sustainable practices and energy efficiency in semiconductor manufacturing. By weaving green technology into our processes, we’re crafting a brighter, cleaner future for our planet and industry alike.

How Are Startups Impacting the Korean Semiconductor Landscape?

Startups are transforming the Korean semiconductor landscape through innovation and securing funding, though they face challenges in a competitive market. By focusing on niche areas, they’re driving technological advancement and creating new growth opportunities together.

What Role Does Education Play in Supporting the Semiconductor Workforce?

We can’t overlook education’s essential role in workforce development. By enhancing technical training, we’re not just filling positions; we’re shaping future innovators, important for meeting the industry’s evolving demands and overcoming talent shortages.

How Do Semiconductor Trade Policies Affect South Korea’s Export Prospects?

We’re seeing significant tariff impacts affecting South Korea’s semiconductor exports. To navigate these challenges, we’re adapting our export strategies, focusing on innovation and international partnerships to maintain competitiveness in a rapidly changing trade landscape.